During Q3, the prices of the majority of game tokens continued to fall.

Only three of the top 10 tokens have seen their prices rise during 2024.

Sector investment was $128 million, down 57% compared to Q2.

Pixels remained the most popular blockchain game in terms of daily onchain activity.

One bright spot was the growth of Telegram games supporting the TON blockchain.

However, the post-airdrop issues of Hamster Kombat and Catizen demonstrates the weakness of many of these initial experiences.

With one exception, most blockchain game sector metrics continued to decline in Q3 2024, albeit at a slower rate than in Q2.

That exception was the adoption of Telegram and its adjacent TON blockchain as a key opportunity for the viral marketing and distribution of airdropped tokens based on players' activity in mini-games.

Following on from the launch of NOT – TON's first gaming meme token – in Q1 2024, notable games such as Kombat Hamster and Catizen hit the headlines, citing extremely high user numbers; 300 million and 30 million respectively.

Even assuming a very high proportion of bots, these games clearly had managed to generate strong social engagement from lightweight gameplay; something which caught the attention of many blockchain game developers, who were otherwise struggling with declining crypto sentiment and a lack of commercially-viable paid marketing options.

The result has been an explosion in Telegram mini-games and, specifically in terms of this report, Telegram mini-games that support the TON blockchain in some manner.

In terms of raw data, 265 TON games were announced during the quarter, taking the total from 120 at the start of Q3 to 385 games by the end of the period.

Of course, this sort of velocity is only enabled as most of these games are currently very simple experiences, in many cases also being hypercasual games ported from other social media platforms. Their ephemeral nature quickly became apparent too, with both Hamster Kombat and Catizen experiencing sharp falls in user numbers – as well as some community disquiet – following the eventual airdrop of their promised tokens.

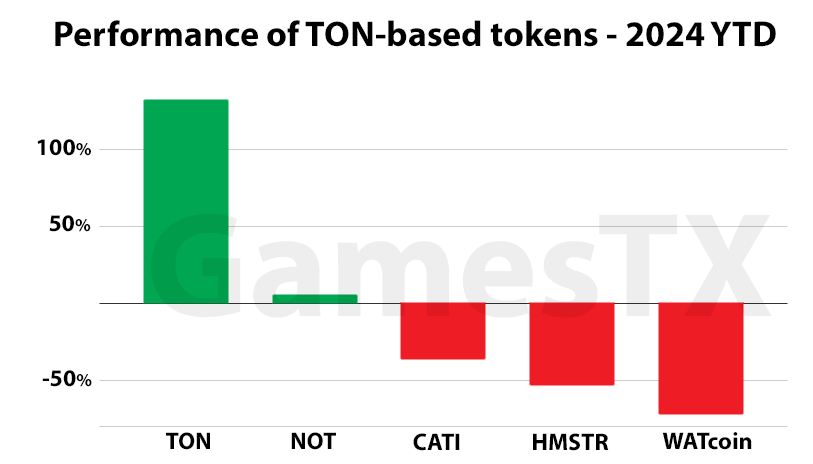

Notably, both the HMSTR and CATI tokens experienced continuous drops in their token price post-launch.

Also demonstrating fast-diminishing returns of the initial Telegram mini-game plus TON integration playbook, the Animoca-backed Gamee's WAT protocol only managed to attract a few million users. Its WATcoin experienced a larger price decline post-launch than Hamster Kombat and Catizen.

However, with Telegram now claiming around one billion accounts, many commentators are convinced this is just the start of blockchain game developers' attempts to leverage what they believe is a massive new opportunity.

Obvious examples include releasing more complex experiences as well as multiple games with interoperable assets and metagames to extend retention.

Developers are already releasing Telegram mini-games, which link back to blockchains other than TON, with Tatsumeeko's Lumina Hunt requiring users to log in through their Ronin Waypoint wallet to claim rewards and Boomland similarly invoking Immutable's Passport wallet.

Check out the full report, which also covers:

most popular games,

token performance

investment trends, and

ecosystem trends

>>here<<

Sponsored by Hiro Capital: investing 📈 in the future 🔮 of gaming 🎮

Calendar

Decentraland releases beta of first desktop client — 22nd October

Ubisoft’s Champions Tactics goes live — 23rd October

Planet Mojo’s free NFT mint on Base — 23rd October

Ragnarok: Monster World play-to-airdrop ends — 7th November

Next FOMC meeting: 50bps cut now not expected — 7th November

Blast Royale’s NOOB token goes live — 13th November

The Sandbox Alpha Season 4 ends — 17th December

More Q3 Data

It’s always good to cross-check your data against other reports. Konvoy’s general gaming Q3 2024 report notes that gaming VC deals were at an all-time low (since Q1 2020) — with only 92 recorded, of which 77 were early-stage deals.

As an aside, I will also point out that Konvoy has listed ID Planet’s reported $80 million raise for its “web3 EVM blockchain and metaverse gaming” in its report, which I didn’t because of the lack of clarity around the Chinese project and the very unclear reputation of the alleged investors.

For some reason, Konvoy also includes Azra Games’ Series A in its Q3 report but seems to have done so based on early rumors of a $32.6 million investment. The round was finally announced in October (Q4) at $42.7 million, which demonstrates the peril of trying to be too clever by half — not something I’d ever be accused of!!

ApeChain Live news

Yuga’s infrastructure play ApeChain is now live and — amongst other things — offering holders of APE token the ability to gain automatic yield instead of the manual staking claim process on Ethereum. It will also launch its .ape ApeNames web2 and web3 domains, while degen trading sim Top Trader app is getting plenty of attention.

The result is the price of ApeCoin has risen 111%, regaining a position in the top 100 crypto ranking.

Additional Links

Axie Infinity is launching an Instagram account.

Why VanEck invested in Parallel Studios (and is bullish on blockchain games).

The knives are out for Big Time — “There’s no communication, no commitment to building, and honestly, I’m not even sure they know how to build a functioning game.”

Check out the Big Blockchain Game Report 👀 Q3 2024 👀 here.