Back in the mists of time, I used to write the DappRadar x BGA monthly game sector reports. But thankfully for everyone concerned, those days are long gone and I can now just read the fruits of other people’s labour.

August’s report is a good one; full of interesting data.

I was particularly happy to cross-reference my proprietary investment numbers with DappRadar’s estimates.

It cites $750 million into the sector during August 2022, compared to my $721 million, which is a reasonably matched 4% difference.

We’re also in agreement that $1.1 billion has been raised during Q3 2022 to-date, although I wouldn’t be quite as bullish yet about whether the sector will break the $10 billion mark for the year.

DappRadar predicts $10.2 billion.

Extrapolating from my data brings me $9.4 billion, and that assumes an average of around $800 million announced for every forthcoming month, which is certainly possible, but by-no-means certain.

To-date, only five months have beaten this total, and most of those have seen very large single investments announced such as Forte’s $725 million (Nov 2021) Sorare’s $680 million (Sept 2021) and Yuga Labs’ $450 million (March 2022)

As a remainder, the total investment into the sector during the whole of 2021 was around $4 billion, so the $6.5 billion injected to-date in 2022, is already a 60% rise on that.

And, without getting too nerdy about it, I think it’s also worth pointing out that one of the big issues of this data is how you handle announcements such as Animoca raising $100 million from Temasek (*see further discussion below the fold).

Clearly this is investment into the sector, but given that Animoca’s main activity in the sector is investing, there’s also a clear concern around double counting.

When Animoca makes new investments into blockchain game companies from that $100 million, that money has already been counted.

It’s the same for the big ecosystem funds that blockchains raise, such as Flow’s $725 million and Polygon’s $450 million, which are not 100% focused on games either.

Interestingly DappRadar raises the issue in the following graph — with the yellow slice — although doesn’t overtly discuss the potential for double-counting.

Personally I try to not get too hung up on the numbers.

In general, it’s best to have a healthy scepticism, especially when it comes to psychologically anchored, nice round and big numbers such as 10 billion.

So for all the purists out there, during 2022 to-date, if we look at the funding purely for the developers of blockchain games, it’s still a fairly impressive $1.6 billion.

But, of course, the blockchain game sector isn’t just about games: that’s the point and that’s the problem!

This Substack is sponsored by Hiro Capital: Tell us what you’re doing here.

Updated Funding news

Further to the reports in August that Animoca was raising a $100 million from new convertible notes via Singapore sovereign wealth fund Temasek, comes the formal news Animoca has raised $110 million from new convertible notes.

Temasek was the lead with other new investors in the APAC-centric round included Boyu Capital (China), and GGV Capital (US). Existing investors Mirae Asset Management (South Korea) and True Global Ventures (Singapore) also participated.

The annoying thing is that now I’m going to have to redo all my investment data and graphs (as above) to move this investment from August to September.

The new graph looks like this.

As I always say, never trust the dates when funding is announced.

AxieCon 2022 news

Plenty of news from the first AxieCon event, notably that what was previously called Axie Infinity: Origin is now officially Axie Infinity: Origins.

One reason given is to avoid confusion with the 4,000-odd Origin Axies, which are the most valuable subset in the NFT collection (this includes the 1,000-odd Mystic sub-sub-set too).

Also announced was the ability for players to upgrade Axie parts; something that will require the consumption of resources and materials. Conversely, accessories will allow players to customize their Axies with cosmetic items.

There’s now an official trailer, with an interesting end reveal of new characters.

The really big announcement, however, was around what Sky Mavis is calling Project K - Land, which is the meta game using the land NFTs.

It’s hoped that an off-chain alpha version will be released at the end of 2022, to enable players to gather resources, create buildings and then craft items. There will also be an auction house and idle combat.

And the surprise announcement was Axie Infinity Raylights, a separate mini-game that also uses lands NFTs. Scheduled to launch in September, this enables players to grow plants, which they can use to decorate their land

STEPN Down news

Despite being a regular runner, I haven’t had a lot of joy with move-to-earn game STEPN. The mobile app and wallet works fine but connecting to the server … doesn’t like it one bit.

That’s not the reason for the decline in the userbase, of course.

The game’s utility GST token is down 99% YTD, although the governance GMT token is up 380% (at least in terms of Coingecko’s tracking), albeit down 84% from its all-time high.

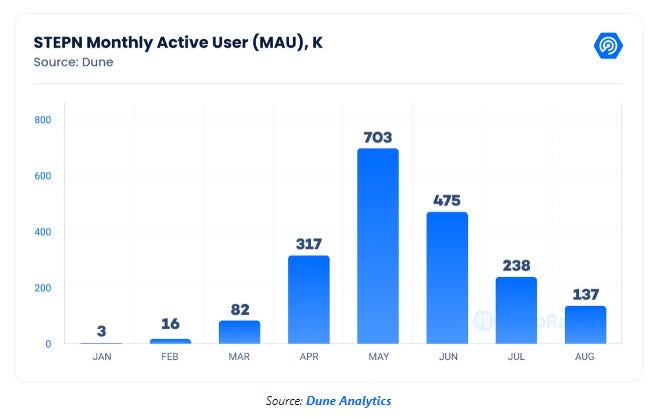

No surprise then that the userbase is following the usual trajectory.

Still, despite all the issues and the decline, I expect the project to end up as a ‘1’ rather than go to ‘0’.

If nothing else, the project generated $123 million in Q2 2022 from minting and marketplace fees.

Plenty of roadway to go, even if they have to take the time to reboot their vision — much as Sky Mavis has now done.