The end of the month always kickstarts a flurry of activity as I go through the process of updating my various blockchain gaming sector KPIs.

You can delve into the data via my Everything Blockchain Gaming dashboard.

First up, it’s the most popular blockchain games in terms of their onchain activity and in the six years I’ve been creating these graphs, I don’t think I’ve seen anything quite as stark as April’s lines.

As the legend reflects, on this metric at least, the entire sector is Pixels and everything else.

For, back in late 2021, while Axie Infinity was the most popular game by far, there was also Splinterlands and Alien Worlds, which attracted hundreds of thousands of daily active unique wallets apiece.

Today, however, Pixels’ growth — up 572% in 2024 YTD — seems likely to see it break Axie Infinity’s peak of 1.1 million DAUWs at some point in 2024, while the closest competitor is well under 100,000 DAUWs.

Of course, there are some gaming projects that do attract more than six digits of daily wallet activity but these are either game-like apps such as move-to-earn experience Sweatcoin or games that are encouraging people to ping a smart contract in transact-to-token-airdrop mode for a short-term event.

In contrast, Pixels is a proper game, probably with a percentage of bots but also with 200,000 wallets paying $10 a month for its VIP membership, which means that as well as being the most popular blockchain game, Pixels is also the blockchain game that’s generating the most in-game revenue too.

That’s a double whammy which is hard to beat.

Not that this has made Pixels’ PIXEL token a good investment. Its value is actually down 24% since its 19th February 2024 launch.

But that’s very blockchain, as market sentiment in the short term is rarely connected to hard KPIs. Indeed, market sentiment is currently extremely dynamic, with the bull market confidence of the first quarter quickly dissipating.

Personally, I think that’s a good thing as there were clear signs the market was getting over-heated, with multiple examples of insider cartels working together to dump on crypto retail.

Never a nice atmosphere and certainly not a sustainable one.

Which isn’t to say that there isn’t still frothiness in the market. Despite recent conditions, of the top 20 gaming cryptos, eight are ROI positive in 2024 with the launch of Yield Guild Games’ YGG token on Sky Mavis’ Ronin blockchain, Ronin’s underlying RON token and Parallel’s PRIME token some of the better performers.

However, it’s worth pointing out that at the end of March, only four of those top 20 gaming cryptos weren’t ROI positive, as detailed in the Big Blockchain Gaming Report Q1 2024.

Outside of the top 300, the top performer is Guild of Guardians’ GOG token — up 84% in 2024 — which is pumping prior to the release of the mobile RPG through app stores on 15th May 2024.

I’ve played some early versions and personally am very much looking forward to its release. Guild of Guardians will also be one of the first games to launch on the Immutable zkEVM blockchain infrastructure, so there’s plenty of anticipation building. Do your own research, obviously.

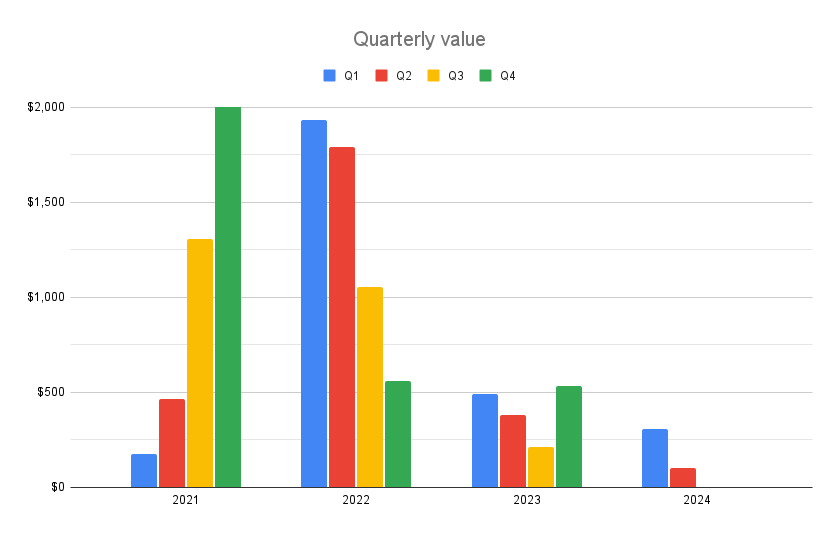

As for other KPIs, the main one I consider is investment activity into the sector, but in terms of the value of deals, there’s really not much to report. So far, I’ve tracked $99 million of inbound investment in April, which is up from January ($63 million) and February ($76 million) but much less than March’s $169 million.

Total investment in 2024 to-date is $407 million, down 43% compared to the first four months of 2023.

The reason is that traditional VCs and PE outfits are not active in the market so the deals are either small or based around token or node launch events or both.

The glory days of late 2021-to-mid 2022 are long gone and now appear to have been a particular strong burst of covid-led irrational exuberance, which as yet has not resulted in many success stories.

But, as the example of Pixels demonstrates, the best projects are still building and finding their audience. The chaff is blowing away. The wheat will deliver its harvest in due course.

Sponsored by Hiro Capital: investing 📈 in the future 🔮 of gaming 🎮

Calendar

Lattice’s Redstone L2 goes live — 1st May

Mocaverse MOCA token sale ends — 2nd May

Axie Infinity: Homeland gathering showdown ends — 3rd May.

Heroes of Mavia launches its Ruby NFT marketplace — 5th May

Guild of Guardians’ global launch via app stores — 15th May

Next Project Awakening playtest — 21st May

Decentraland Game Jam starts — 26th June

Blockchain Gaming World #166 news

Another Wednesday, a new episode of my Blockchain Gaming World podcast is out: but you already knew that because you’re subscribed, right?

Episode 166 saw me catching up with Steve Wade, the CEO of US outfit Midnight which is planning to launch multiple games through its Evergreen multiverse, which he labels a deconstructed MMOG.

You can read the transcript here and check out the interview with appropriate timestamps below or via your podcast provider of choice.

Keep reading with a 7-day free trial

Subscribe to GamesTX to keep reading this post and get 7 days of free access to the full post archives.