The summer months are always weaker when it comes to public funding announcements. Everyone important is on holiday.

But for the blockchain gaming sector, summer 2024 is shaping up to be particularly barren.

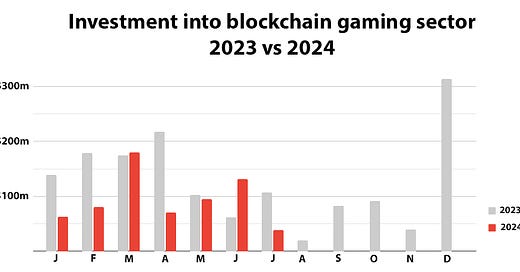

July saw $38 million-worth of investment, which is the second lowest monthly amount I’ve tracked in the past 3 and a half years. Only the $20 million logged in August 2023 was lower.

More generally, though, the running comparison with 2023 isn’t nice. To-date, I’ve tracked $658 million invested into the sector during 2024, down 33% on the $981 million announced during the equivalent period in 2023.

For the record, 2023’s full year total of $1.5 billion invested was down 71% compared to $5.3 billion in the boom year of 2022, and down 62% on 2021’s total of $4 billion.

Significantly the reason isn’t a lack of deal-making.

If we look at the number of deals and other funding events announced, 2024 has proven to be fairly buoyant: the 158 deals logged to-date is up 26% on the comparative period in 2023.

The issue has been these deals have generally been sourcing money from small crypto-only funds and/or crypto retail investors.

These are limited in terms of capacity and as crypto sentiment soured from May onwards, retail funds dried up almost completely. It’s not a situation that this week’s general liquidity squeeze will have done anything to improve.

The only silver lining is that smart (or brave) capital can now start to think about deploying into the best of the now-heavily discounted live gaming tokens which have launched in the past seven months. Some of them are priced extremely competitively, assuming you don’t think crypto is heading into a bear market.

Again, this isn’t good news for projects looking for new funding. Not only are they competing with other startups, they’re also competing with everyone who’s got a live token.

Not helpful advice to anyone trapped in this predicament, nevertheless it should underline that the sector’s fixation with tokens as a fundraising mechanism *and* a payment/engagement fundamental remains deeply flawed when both elements are held hostage by extremely volatile speculative sentiment.

Sponsored by Hiro Capital: investing 📈 in the future 🔮 of gaming 🎮

Calendar

Craft World’s Epic Era 3 launches — 7th August

Revolving Games’ RCADE node sale — 15th August

Ubisoft-backed The Watch launches its alpha — 28th August

Polygon upgrades, MATIC becomes POL — 4th September

Ubisoft Embraces The Madness news

Reinforcing the rule that any game with "game" in its title probably isn't a game that’s easy to understand, Ubisoft Labs has announced Captain Laserhawk: the G.A.M.E..

Extending the conceits of its Netflix adult-rated animated series Captain Laserhawk: A Blood Dragon Remix, which was a mash-up of various Ubisoft IP although centred around characters from Far Cry 3: Blood Dragon, CL;tG. is set in an dystopian version of 1992 America, in which the face of the evil regime is a coke-snorting Rayman. Because why not?

Gameplay-wise, we're promised a competitive top-down shooter, which blockchain-wise will leverage Sequence's tech and run on Ethereum L2 Arbitrum.

However, because this probably isn't a game that’s easy to understand, the main point of CL;tG is an experiment in decentralized governance, or as the press release puts it “a transmedia gaming adventure where the community drives the narrative through innovative governance”.

There will be 10,000 Citizen ID NFTs, which as well as gating access to the game and various rewards, will also record players’ governance activity and leaderboard placements. Ubisoft says “the entire community will have the opportunity to influence the plot and participate in key decision-making moments by unlocking, creating, and sharing content”.

Blockchain Gaming World #176 news

Continuing my education into why so many blockchain game companies are piling into Telegram, I spoke to Bozena Rezab from Gamee, who knows the messaging platform better than most.

Indeed, eight years ago, Gamee was a launch partner when Telegram first launched its gaming initiative. Of course, back then, Telegram didn’t have 950 million users but that’s not the only thing that’s changed.

As we discuss, recent additions include the platform-wide Stars IAP payment system which have combined with account-integrated TON blockchain and wallet, plus a native ad network, which pays out in TON. Throw into the mix the level of virality arising from those 950 million users and this means Telegram is now the go-to place for launching the sort of “snackable gaming experiences” Gamee has always offered.

‘We used to have 300,000 DAUWs on Telegram. We now have 4 million active wallets from a total audience of 55 million accounts,’ Rezab explains, highlighting there is no comparison with other blockchains in terms of how quickly you can build a crypto audience.

And yes, a lot of this activity comes from bots, but as Bozena and last week’s guest Simon Davis stress, there are a lot of humans too.

Keep reading with a 7-day free trial

Subscribe to GamesTX to keep reading this post and get 7 days of free access to the full post archives.