With many blockchain games running incentivized activities — whether social farming or via leaderboards and gameplay — onchain activity during the summer has been volatile on the up and down sides.

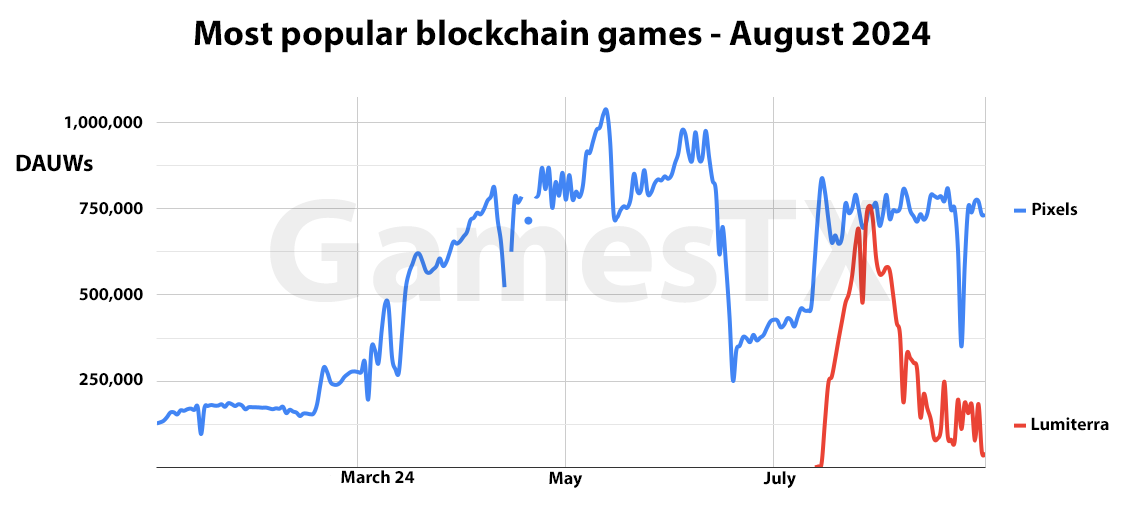

When it comes to the most popular games, Pixels remains #1 with around 750,000 daily active unique wallets, albeit with an assumed 70% bot rate.

MMORPG Lumiterra, which also runs on the Ronin blockchain, matched Pixels’ audience but only for a day when its daily fragment claim and first closed beta test went live.

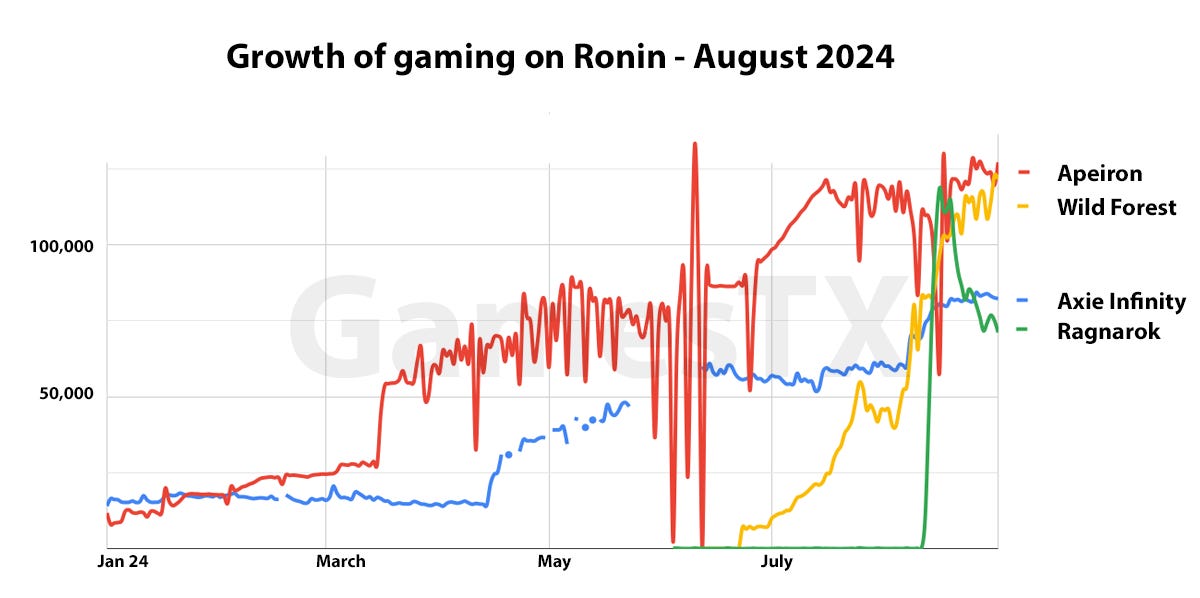

And — for similar reasons — Ronin has been the chain for gaming activity this summer.

New game Ragnarok: Monster World has been running various campaigns, also launching its first closed beta test in August. The test attracted a total of over 30,000 unique playing wallets, with a peak audience of over 100,000 daily active unique wallets generated through all activity in mid-August.

The game is now available for pre-registration through app stores with an expected late September launch.

Axie Infinity continues to see growth, thanks to Sky Mavis’ continued daily AXS token giveaways, while Apeiron’s ongoing leaderboard-based giveaways for people playing its dungeon demos are still growing its audience.

The most impressive growth, however, has come from mobile RTS Wild Forest, which has broken the 100,000 DAUWs ceiling as it builds to the launch of its WF token.

Of course, what will be vital in the medium term is how well these projects can sustain audiences when games are properly live and incentive levels are reduced to more normal levels i.e. bots and extractive players are removed

Nevertheless — thanks to the volume of launching games — Ronin remains the blockchain which will likely see the most momentum in the remainder of 2024.

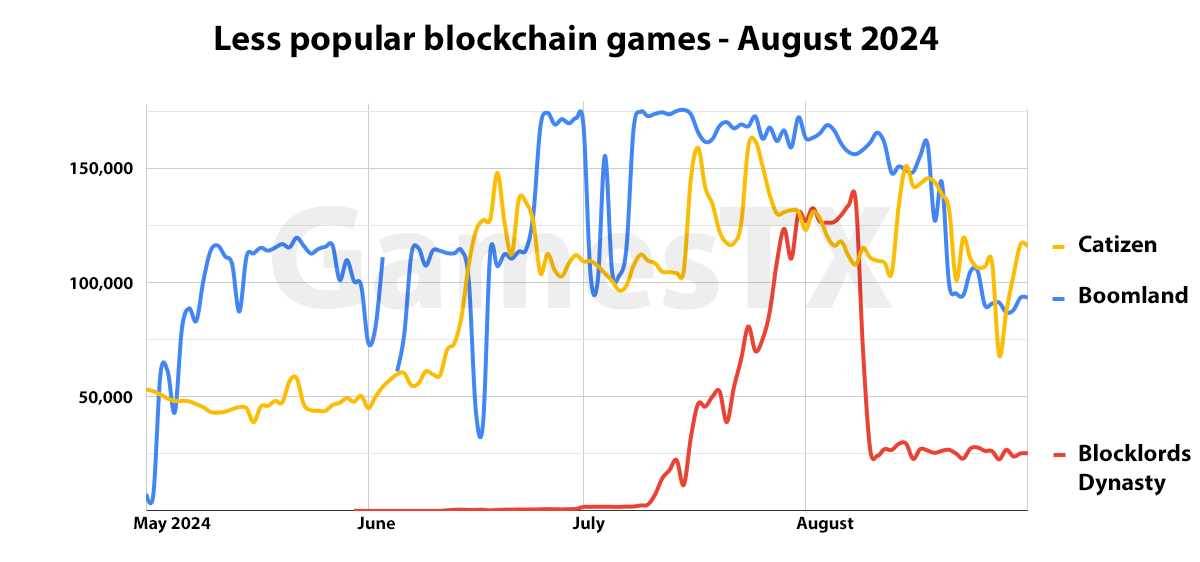

The impact of withdrawing incentives on audience can clearly be seen when it comes to titles including Blocklords Dynasty. The fully onchain browser game peaked at 130,000 DAUWs during its first LRDS token event in early August, dropping to a steady 25,000 DAUWs when the event ended, leaving actual players.

The audience for the Boomland ecosystem, which includes Hunter On-Chain, also declined in August as its first BOOM campaign ended. Telegram mini-game Catizen is building to the launch of its CATI token so daily activity remained steady.

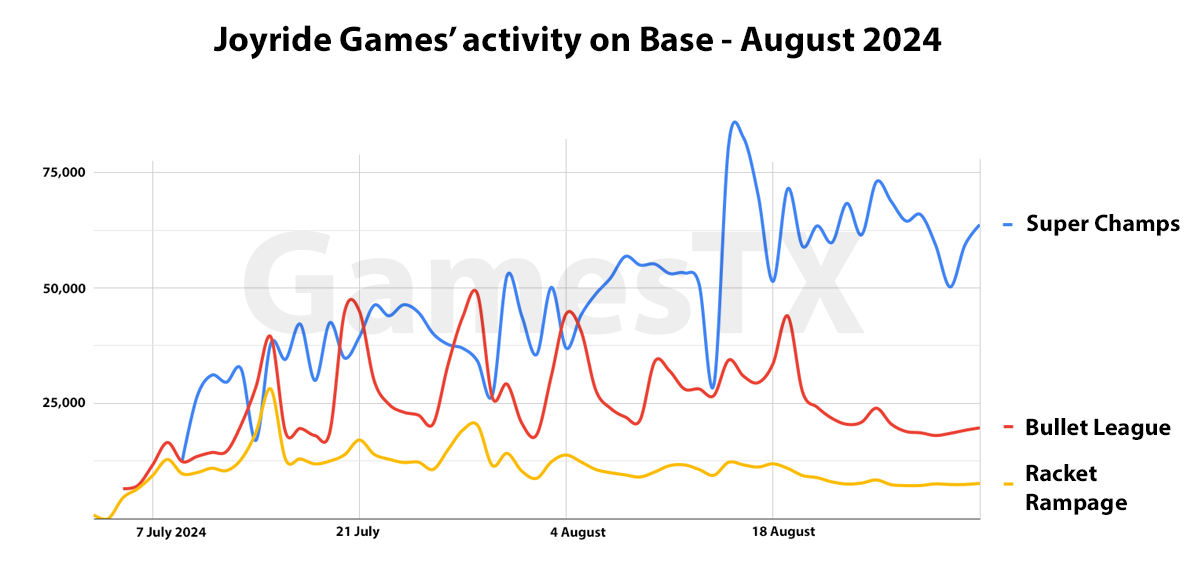

A final graph looks at the result of Joyride Games’ migration from the Flow blockchain to putting all its apps and games on Base. In the build up to its CHAMPS token launch, the Super Champ app is driving most activity, while mobile games Bullet League and Racket Rampage dropped.

As with Ronin, Joyride will be keen to see the balance reversing from app to games post-token-launch.

This — and more — is discussed in my regular roundup video.

Sponsored by Hiro Capital: investing 📈 in the future 🔮 of gaming 🎮

Calendar

Polygon upgrades, MATIC becomes POL — 4th September

Nyan Heroes launches Season 3 playtest — 4th September

Flow launches EVM compatibility — 4th September

Game community Tribal’s TGE on Base, Ronin and ETH — 5th September

US FOMC meets; ≥25bp rate cut expected — 18th September

Hamster Kombat’s token will (air)drop — 26th September

Champions Tactics’ open beta launches — TBA September

BCGW #177 news

Blockchain Gaming World episode 178 is now out via YouTube and all the usual podcast providers. I talk to Stone Blade Entertainment’s CEO Justin Gary about his career as a player and then a designer of deck-builders and TCGs, which has led him to the launch of SolForge Fusion, which was designed alongside Magic’s Richard Garfield.

The game is designed to be played as a physical experience, while the PC version is live on Steam — with mobile coming — and now blockchain elements are going live on Solana, including a token and the ability to mint and trade your decks.

As you’d expect, plenty to talk about.

The Sandbox Externalizes news

The Sandbox’s Sebastien Borget has been out-and-about selling the latest initiative for the blockchain metaverse that continues to swerve a global persistent launch.

One significant move is the launch of Voxel Games, which he hopes will encourage indie developers to make content external to the platform, including using pro tools such as Unity and Unreal.

This would solve some of the problems The Sandbox is clearly suffering from as devs could make their own standalone experiences that would support any of the platform’s catalog of assets, also allowing users to log in with their existing wallets.

More generally, Borget spoke about how India has become the top location for creators with 66,000 creators compared to under 60,000 in the US and 25,000 for crypto-friendly Brazil. Presumably these are prosumers who are using its no-code tools.

But — basically — The Sandbox really needs to sort out a nailed-down global release schedule.

Keep reading with a 7-day free trial

Subscribe to GamesTX to keep reading this post and get 7 days of free access to the full post archives.