Most popular blockchain games of 2023

Reading the tea leaves

Happy new year. I hope you had a relaxing break because it’s going to be interesting next 12 months.

But before we head into all that, let’s take time for a final look at some of the data points arising from 2023.

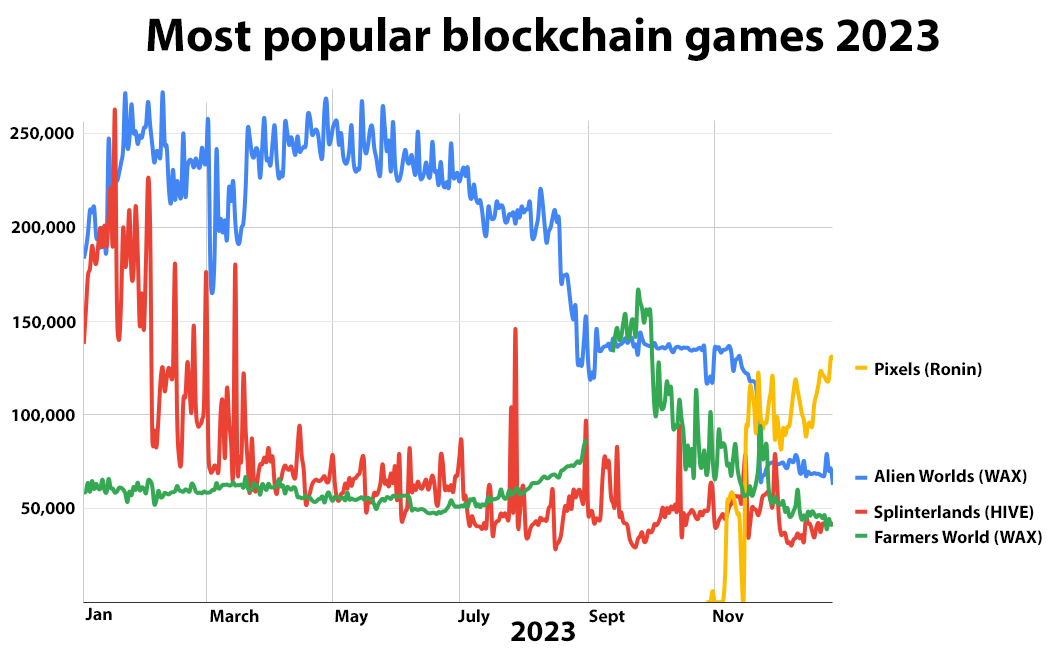

The first series I’m looking at this week are the most popular blockchain games as measured by their onchain activity, filtered from DappRadar’s raw data.

Of course, onchain activity can be a tricky metric but does have value, not least to highlight comparative trends: something I consider on a monthly basic. For those who are really keen, here’s a playlist of videos on the subject going back to February 2020, when the most popular game boasted 4,000 daily active unique wallets. OG days indeed!

But before we start, it’s worth thinking more generally about broader sentiment in the crypto market during 2023, which reflected the performance of some key games during the year.

Things started at a low ebb and while the Bitcoin price climbed steadily throughout the year, for most other tokens, there was actually a local spike during Q1 followed by a slow crushing decline which hit a nadir in the summer — and for some tokens such as AXS as late as October — prior to the Q4 pop which we’re now enjoying.

Obviously it’s worth pointing out that for most games, token price is a key driver of how many people (or bots) interact with them.

Certainly I think this was the main driver of declining activity for the two games which started 2023 — and 2022 — as the most popular blockchain games in terms of their onchain activity: Alien Worlds and Splinterlands.

Alien Worlds started 2023 with 183,000 DAUWs, which declined 66% during the year whereas Splinterlands’ started with 138,000 DAUWs, dropping 70%.

In terms of their tokens’ value, Alien Worlds’ TLM token lost 25% of its value, hitting an all-time-low on 2nd September before rebounding to end the year up 57%. Splinterlands’ SPS token lost 44% of its value, hitting an all-time-low on 9th October before ending the year up 66%.

Linked to this were the games’ continued efforts to reduce the ability of bots to extract value, which also reduced audience, although I think the price of tokens was likely the more vital influence.

It’s also worth restating that these are now some of the oldest blockchain games so it’s not surprising they’re suffering from a level of player churn. Additionally, neither is set up for the sort of live ops expecting from say high performing mobile F2P games.

But it wasn’t all doom-and-gloom as demonstrated by the rise of Pixels.

The browser-based social RPG had been around for a couple of years, launching its land NFTs on Polygon in January 2022. But moving from Polygon to Sky Mavis’ Ronin blockchain in November 2023 proved to be the perfect launchpad to combine its existing niche audience with those set up on Ronin because they had previously played Axie Infinity. Collaborations with communities such as Mocaverse also appear to have brought new players into the game.

Combined with general positive sentiment — the price of Pixels’ farm land NFTs is up 963% since October to a floor price of over $4,200 — the game quickly became the most popular title in terms of onchain transactions, breaking through 100,000 DAUWs, and continues to grow.

At time of writing DappRadar has it at >130,000 DAUWs.

The other set of games worth considering in detail are those I’ve described as “less popular blockchain games” because while I think they are solid experiences, their audiences are measured in the low tens of thousands.

Again, both mobile Monopoly-style game Upland and Axie Infinity Origins are titles that have been around in various forms for years.

Neither demonstrated much dynamism during 2023 in terms of onchain activity with Upland’s audience being flat. And while Axie’s daily activity actually grew by 96% — in part due to its own app store-based mobile launch — it’s become clear that despite all the work Sky Mavis is doing to improve and innovate the game, it’s highly unlikely to reclaim late 2021’s peak of 1 million DAUWs.

Instead, South Korean idle RPG Nine Chronicles was the significant mover, growing its audience 88% to around 40,000 DAUWs. However, this number only covers the original version of the game, which was joined in November by a new version called Nine Chronicle M. It runs on its own blockchain, however, and this isn’t currently being tracked by DappRadar.

For what it’s worth developer Planetarium says the combined audience is 115,000 monthly active unique wallets (MAUWs), split equally between the two titles.

What’s next?

One key trend arising from this data is whether these sort of traditional blockchain games will be the products to take the best advantage of current tailwinds.

I’m not going into detail but the graph below of the activity from non-traditional blockchain “games” and viral experiences — these are all logged as games by DappRadar — heavily suggests they will not.

Keep reading with a 7-day free trial

Subscribe to GamesTX to keep reading this post and get 7 days of free access to the full post archives.