As the archetypal early adopter, my fatal weakness is I have difficulty understanding why everyone isn’t immediately jumping onto this new technology, whatever it happens to be.

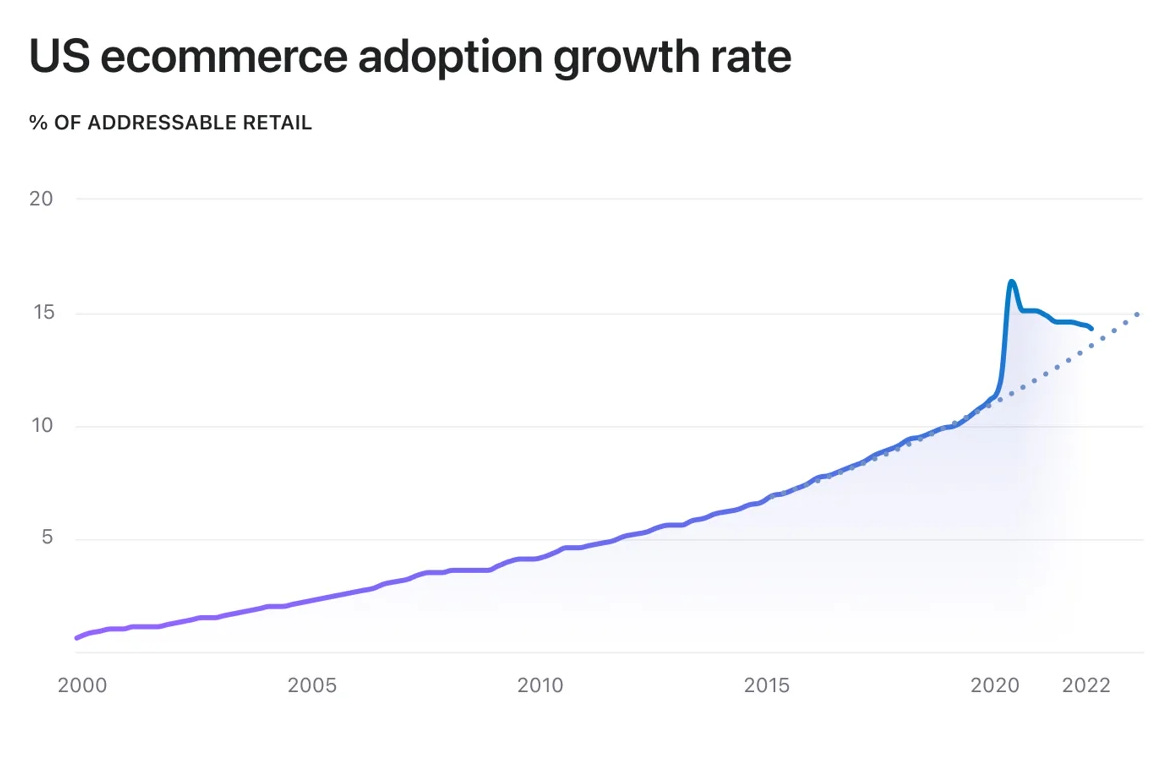

Even so, I was pretty surprised to see the following graph, which isn’t really about what any of us would consider ‘new technology’.

Indeed the context was Shopify’s CEO writing about why the company was having to let go 10% of its staff because the Covid-surge in online retail was returning to its pre-Covid growth rate.

However, my surprise was that 10 years on from widespread internet availability, ecommerce still makes up less than 15% of the total US addressable retail market.

While I’d assume a high percentage of the US population uses ecommerce for some purchases, this data is — I guess — based on dollar-value, for which key sectors such as cars, clothes, groceries, home decor, DIY etc are still strongly offline.

Nevertheless, 15% seems a small share of the market, even if in absolute terms, the US retail market is enormous — between $5 to $6 trillion depending on your source.

So, with my blockchain hat on — and as much as I dislike the concept of ‘We Early’ — this really does put our current position with regards to the $200 billion annual gaming market into perspective.

I’d even argue we’re so early, it doesn’t yet count as being “early” in any mass market context.

That stated, do we actually need to really care about mass market in terms of user numbers?

Personally, I expect to see significant change soon, especially in terms of unconventional metrics such as total value of trading volume, even if this is only for a very select number of projects.

As the truism goes, the future will be distributed in a highly uneven manner.

So perhaps the better question to ask is not ‘Wen blockchain games 15% of game sector revenues?’ But ‘Wen first trillion dollar game in terms of lifetime trading volume?’

That’s a discussion for another time.

This Substack is sponsored by Hiro Capital; always correctly positioned on the Gartner Hype Cycle.

MZ Co-founders In Web3 Stealth Mode Reveal news

My excuse is I was on holiday so I missed it, but I don’t know I would have actually noticed if not on holiday, so well hidden was the — to me — big news that Machine Zone (MZ) co-founders Gabe Leydon and Halbert Nakagawa have announced Limit Break, their blockchain gaming startup.

I won’t repeat too much of my fascination with Gabe — read more in this email from a year ago — other than to say MZ was a key player in the early F2P mobile game sector, launching multiple billion dollar franchises, while leveraging operational skills in UA marketing, community building and very deep meta gameplay

As for what Limit Break is working on it’s not yet clear, although it has already dropped its first NFTs: a 2,022-strong collection called Digi Daigaku that — pre-reveal — has a floor price of 1.8 ETH.

Another mystery is how much money Limit Break has raised. Effectively it could have raised whatever it wanted to at pretty much any valuation.

Nevertheless, its cap table is stuffed with blue chip investors ranging from Paradigm and Standard Crypto as co-leads, also including FTX, Coinbase, Sfermion and Positive Sum plus angels such as Gabby Dizon (YGG), Alex Adelman (Lolli), and Shervin Pishevar.

Thanks for reading the free weekly post from Gamestx.

But to get your daily dose of blockchain gaming news, please subscribe to the paid version.

Funding news

CEO of US mobile studio Firefly Games — Michael Zhang — has announced the formation of MetaWorld Entertainment. The company will act as a developer and publisher of multiple experiences such as events and concerts, and games within various metaverses.

Investors include strategic partners such as The Sandbox and Com2uS and VCs CRIT Ventures and Formless Capital, although the size of MetaWorld’s seed round wasn’t disclosed.

One of its first projects will be SailCraft, a P2E game based on Battleships.

Not well known in the west, but Japanese F2P mobile developer Pokelabo Inc (SINoALICE) was acquired by local giant GREE for $174 million back in 2012. And now the co-founding team including CEO Shunsuke Sasaki has set up developer Murasaki.

Based in The Netherlands, Murasaki is working on new web3 space mining and combat game Cyberstella and has raised $1.5 million in funding, which was led by early stage Japanese outfit Incubate Fund.

The developer expects to launch its NFT and token in late 2022, followed by the launch of Cyberstella in early 2023.

Product news

Now onto its fourth beta prior to its planned early 2023 release, Soccerverse (previous Soccer Manager Elite) is now live in its new browser version and running on Polygon.

Players can buy shares in soccer players and clubs via the in-game DEX — there are thousands of players but only 300 clubs — gaining income depending on their performance during the season.

It’s also possible to become the manager of a club or the agent of player, roles that unlock additional features and earning potential.

The whole economy is connected by the in-game token, with the share prices of players and club rising and falling dependent on market demand.

However, as with previous betas, it’s worth pointing out that the game state will be wiped prior to the actual launch so although players have to spend crypto to participate in the beta, assets don’t have any real world value, making this beta the opposite of play-to-earn.

You can find out more details here.

Steam-on-the-blockchain PC game distribution channel Ultra is finally moving into open beta, at least in terms of its Uniq NFT marketplace. Everyone will be able to download the client and trade NFTs on Monday 29th August.

That stated, Ultra is labelling this version a minimum viable product so there are plenty of improvements still to come, as well as the usual array of new collections and drops.

As for when the first full games will be available, that’s an announcement for another month, or perhaps another quarter.

You can check out my video of testing an early version of Uniq here.

Partnership news

US F2P mobile gaming platform Playstudios, which operates the playAWARDS loyalty network, has signed a strategic partnership with web3 platform Forte to launch a new venture called playBLOCKS.

Playstudios recently acquired web3 outfit WonderBlocks, and it provides the foundation for playBLOCKS. Playstudios will also support further innovation with its $10 million Future Fund which has invested into Forte and game Kryptomon.

Playstudios’ current web2 games include the likes of Tetris, MyVegas Slots, MyVegas Blackjack and MGM Slots, which enables players to win real-world rewards from the likes of MGM Resorts International, Wolfgang Puck, Norwegian Cruise Line, Resorts World, Gray Line Tours, and Hippodrome Casino by collecting in-app points.

PlayBLOCKS will take this concept onto the blockchain, using Forte’s technology to provide a simple wallet solution so players can mint and trade NFTs.

Further links